The second session of the Course on “The Business and Economics of Space” was on Tuesday, Nov 9. This time the topic was the Private Sector of the Space Industry, as distinct from the government, civil or military side. You can find my earlier posts on the first session here, as well as my remarks from pre-school here and here.

The key takeaways were trying to answer three basic questions.

– How big IS the Space Economy ?

– What does the Industry Supply and Demand look like ?

– What are the current industry dynamics ?

There is no easy answer to the question of measuring the size of the Space economy. Different people and organizations come up with different estimates as there is disagreement about how it should be measured. We know that some reports, such as a very busy industry map from SpaceTech Analytics, grossly overestimate who is a space company. Estimates from reliable sources like Euroconsult and Bryce Tech would put the range from $290B to $370B

One of my personal favourite sources is the Space Foundation and their quarterly Space Report. They estimated the Global Space Economy in 2020 as $446.88 B

The breakdowns are interesting for people outside of the space bubble. Roughly just over a third of the revenues are from Ground equipment and just under a third from Satellite services. Government Space Budgets (including Human Spaceflight) are about 27% of the total with the USA by far the biggest of that. Sat manufacturing (3%) and the sexy launch sector (only 1.5% or $5.3B) round it out. Launch gets a lot of attention but it is not a large amount of the total.

How fast is this growing ? Well, the average CAGR is about 4.3 % per annum but that hides a lot of variation within sub sectors. One of the biggest satellite service sectors is TV, particularly Direct-to-Home (DTH) service like Dish & DirectTV or Bell & Shaw Sat TV in Canada. Streaming services like Netflix and Amazon Prime have caused a lot of cord cutting, not only of cable connections but also Satellite TV connections. Hence it is declining by about 8% annually.

Yet, there are industry forecasts that are regularly touted that space will grow tremendously in the next decade. Most famously there is the Morgan Stanley forecast (here) that says Space Sector will be a $1Trillion industry by 2040. Bank of America (here) expects the space economy to triple in the next decade to $1.4 trillion. The U.S. Chamber of Commerce estimates the space economy will grow from approximately $385B in 2017 to $1.5 trillion by 2040.

Where is this forecasted explosive growth going to come from ? Especially if cash cows lie DTH TV are declining. That is the trillion dollar question. That is why we are taking this course !

Where is the demand for space economy services coming from? Historically it was governments, and specifically the U.S. government and its lettered agencies (NOAA, NRO, DOD etc). Currently the public sector still dominates the demand side outside of Satellite Communications (SatCom). The key would be to see more space services migrate to a model where the government as just an anchor tenant and then eventually to be just one customer among many to a private venture. That is the holy grail.

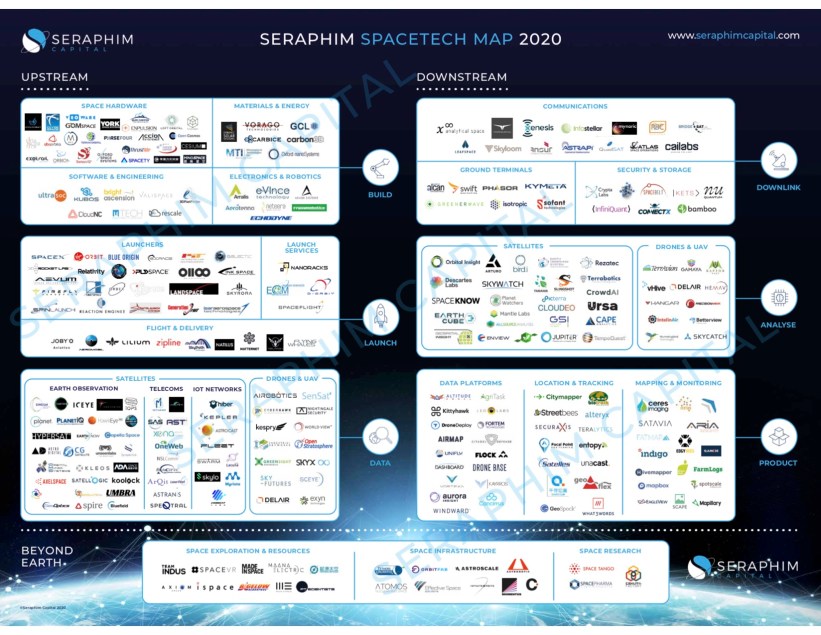

Who are the space sector actors trying to solve this riddle, pursuing this holy grail ? Some are household names now due to their famous billionaire founders ; Musk’s SpaceX & Starlink, Bezos’s Blue Origin & Project Kuiper and Branson’s Virgin Galactic & Virgin Orbit. But there are hosts of companies, as shown in this industry map by Seraphim Capital, the largest Space VC and now a publicly traded investment trust in London, U.K.

The next session will be on Space Financing. Really looking forward to this session ! Expecting to learn more about IPO’s, SPACs and Valuations. Stay tuned for my synopsis on that session next.